What Is an Initial Coin Offering (ICO)?

An initial coin offering, or ICO, is a fundraising strategy in which a blockchain team sells their project’s underlying cryptocurrency in exchange for the funds they need to create the platform. Generally, those funds consist of bitcoin, ether, or both.

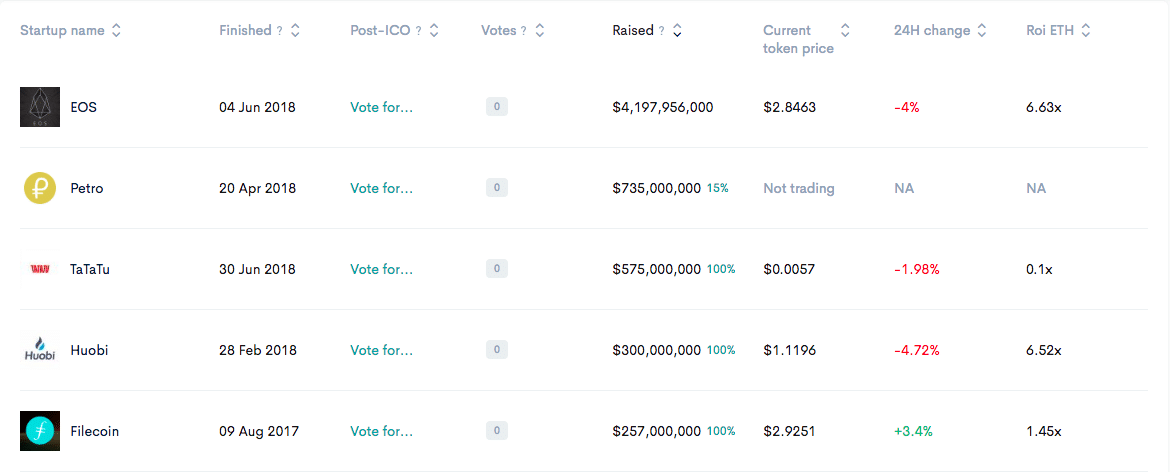

ICOs entered the limelight in 2017 as stories of 24-hour, million-dollar raises began circulating news outlets around the world. Status raised $100 million in June, Tezos accumulated $237 million in July, and Filecoin brought in $257 million in August of that year. Suddenly, it seemed as if any team working on a cryptocurrency could easily raise at least a hundred thousand dollars. ICOs gave young startups the ability to raise significant capital without having to deal with the sometimes ruthless venture capital (VC) firms.

With all the hype that ICOs have received, you may still be wondering, “But, what exactly is an ICO, and how do they work?” Let’s take a more in-depth look at this technological breakthrough and how it’s ushered in a brand new way of raising money. Our explainer includes:

- History of ICOs

- How Does an ICO Work?

- ICO vs. IPO: Are Initial Coin Offerings Legal?

- The Future of Initial Coin Offerings

History of ICOs

Although ICOs gained popularity in 2017, they had already existed for four years at that point. The first ICO occurred in mid-2013 with Mastercoin raising around half a million dollars in bitcoin. The project’s developer, J.R. Willet, proposed using Bitcoin as a protocol base layer for future protocols in his white paper, The Second Bitcoin White Paper, similar to how we use Ethereum today. His project, Mastercoin, would be the first project to help facilitate this mechanism.

Without getting bogged down in the details, Mastercoin was before its time, unable to perform several critical functions due to Bitcoin’s lack of Turing completeness.

It wasn’t until the advent of Ethereum that the blockchain community really started taking notice of ICOs. Ethereum and its scripting language, Solidity, solved many of the initial issues that Bitcoin had with smart contract and decentralized application (dapp) development. Mainly, Ethereum was written in a Turing-complete language, “allowing anyone to write smart contracts and decentralized applications where they can create their own arbitrary rules for ownership, transaction formats and state transition functions.”

The Ethereum team raised around $18.4 million during the project’s ICO in September 2014. And from there, the ICO notoriety snowballed into the avalanche we have before us today.

How Does an ICO Work?

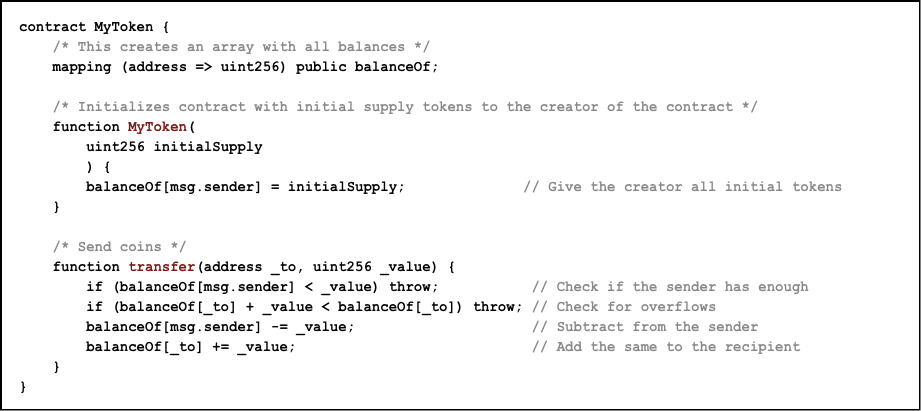

Most, if not all, initial coin offerings utilize some type of smart contract network. These networks vary in their architecture, strengths and ideal use-cases, but they all employ a decentralized blockchain. Popular examples include EOS, Tron and NEO. However, the most popular ICO platform, by far, is Ethereum.

The ERC20 Standard

The majority of tokens launching an ICO on the Ethereum network follow the ERC20 standard. This standard effectively outlines a set of programming rules that all ERC20 tokens must follow. It includes six primary token functions:

- Allowance

- Approve

- BalanceOf

- TotalSupply

- Transfer

- TransferFrom

These six functions enable you to get the total token supply, get an account balance, transfer tokens and approve the token as a form of money. Because these functions are standardized, developers know what behavior to expect when working with any ERC20 token. But let’s get back to ICOs…

Smart contracts are the backbone of ICOs. The open-source programming guarantees that:

- The project receives the bitcoin or ether you contribute,

- You get the project’s cryptocurrency in return, and

- In some cases, you receive your investment back if the project doesn’t reach its minimum fundraising goal.

Smart contracts accomplish all of these tasks automatically and without the need for an intermediary.

The Typical ICO Process

Participating in an ICO is a relatively straightforward process. For this example, let’s focus on an Ethereum-based one.

First, the ICO host mints their new cryptocurrency using Ethereum’s solidity code and places those coins in their own wallet. Following that, as a participant, you send some amount of ETH to the host’s wallet. In return, you receive some of the new cryptocurrency. The amount you receive depends on what value the host gives the crypto when he/she creates it. Since both Ethereum and the new token follow the ERC20 standard, there’s no need to create a separate wallet for each.

And that’s it. Any reputable team will make the smart contracts powering their ICO available to the public. Be wary of any project that keeps this code hidden.

ICO vs. IPO: Are Initial Coin Offerings Legal?

At this point, you’ve probably drawn some parallels between initial coin offerings (ICOs) and initial public offerings (IPOs). In both scenarios, you’re handing over some amount of money in return for what appears to be a stake in the company/project. This assumption is dangerous to make, though, as there are some critical differences between the two:

Initial Public Offering (IPO)

- Centralized

- Heavy regulation

- High-level of bureaucracy

- Investor protection

- Receive stock/equity

Initial Coin Offering (ICO)

- Decentralized

- Little to no regulation (currently)

- No red tape

- No investor protection

- Receive tokens

As you can see, while ICOs do provide some advantages over traditional IPOs (decentralization, no bureaucracy), they also come with more risk. As it stands today, there’s not much stopping a crypto team from running away with your money after an ICO.

An additional risk, you receive tokens instead of equity with your investment. So, there’s a chance that although the company behind your token is successful, the tokens you hold could be worth next to nothing, leaving you up a creek. The success of your ICO investment ultimately depends on the token’s adoption within its ecosystem.

So, Are ICOs Even Legal?

Yes, they are. Well, sort of.

The regulations around ICOs vary from country to country. While countries like Switzerland and Malta have taken a more progressive approach to legislation, others, such as the United States, are still working out the regulatory kinks.

In the United States, the Security and Exchange Commission (SEC) has stated that most ICOs are instead security offerings because the tokens that they offer are securities due to failing the Howey Test. Therefore, the teams behind them need to register with the SEC – something they haven’t been doing. On top of that, the Commodity Futures Trading Commission (CFTC) classifies tokens as a virtual currency requiring a different set of licensing, and the Internal Revenue Service (IRS) has its own classification, muddying up taxes regarding them.

If your head is spinning right now, you’re not alone. Throw in the fact that each state also has its own set of regulations and you can understand the current difficulty in running a legal ICO.

[thrive_leads id=’5219′]

The Future of Initial Coin Offerings

Although their regulatory landscape is uncertain, it’s clear that initial coin offerings, or some alternatives, are here to stay. Even in 2018’s bear market, there were over 1250 ICOs that raised a cumulative $7.85 billion – over a billion dollars more than 2017.

More generally, tokenized fundraising is beginning to blend more and more with traditional methods. We’re starting to see Security Token Offerings (STOs), Equity Token Offerings (ETOs) and even Simple Agreements for Future Tokens (SAFTs), a spin on the favorite YCombinator-created SAFE.

With higher liquidity, 24/7 trading and the elimination of middlemen, it looks as if the future of tokenization, including more ICOs, is on its way.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.